Budget Planning: 5 Awesome Wins for An Earlier Retirement

By Ross Marshall. Posted: December 2020

Who doesn’t want to retire early? Imagine leaving your day job and enjoying the rest of your life carefree and happy on a faraway beach. The question is, how do you strike a balance between living your day-to-day life while still budget planning for early retirement? Read this article to know precisely how you can do that!

In this article:

- The Implications of Retiring Early

- How Much Money Do I Need to Retire?

- 5 Budget Planning Tips for Early Retirement

Want to Retire Early? Here’s What You Need to Know About Early Retirement Budget Planning

The Implications of Retiring Early

There really isn’t much of a difference between planning for your retirement at an earlier age (like when you’re 35–45 years old) or a more traditional age of 60–65 years old. Everything you need to do to secure a worry-free retirement in the future, such as budget planning, constant saving, and wise investing, stays the same.

There are two key differences, and they’re big ones—time and inflation.

Earning more in less time

With traditional retirement planning, you have time on your side. Let’s say you’re 20 years old today. Retiring in your 60s gives you more or less 40 years to safeguard your finances. You can earn your keep while building your savings and diversifying your investment portfolio.

Forty years is a lot of time to get your finances together. You’ll be productive for longer, too. So, you can continue to work and save over 40 years and still hit your financial goals as you reach your retirement age.

But if you’re eyeing early retirement, say by the age of 40, you only have half the time to build on these things! Plus, you’ll need more money since you’ll be retired for longer but working for less.

Simply put, early retirement pushes you to fast-track all your retirement and budget planning preparations. It’s true that retiring early lets you enjoy your free time longer. This path, however, entails you to build more wealth that much faster.

Dealing with inflation

Even if you earn and save enough money for your retirement, inflation rates can quickly eat away at your hard-earned retirement fund.

What is inflation and how does it affect me?: The Reserve Bank of Australia (RBA) defines inflation as the “increase in the level of prices of the goods and services that [Australian] households buy.” In other words, as time passes you need more money to buy the same stuff.

Inflation hits especially hard for early retirees. That’s because inflation rates do the most damage over a long time.

Imagine you were able to set aside $10,000,000 in savings, the amount you feel you can retire on right now. According to Macrotrends.net, the Australian inflation rate was measured at 1.61% for 2019. With an inflation rate at 1.61%, your 10 million in savings will only be worth 9.8 million the following year (10 million minus 1.61% due to inflation). So in reality your current retirement savings will be worth less than it is in the future.

Apart from a select few asset classes you can invest in to mitigate your investments’ exposure to inflation (watch this space for a future article on the topic), the only real way to get around inflation is to earn and save much more upfront so you can secure your finances in time for your early retirement.

How Much Money Do I Need to Retire?

By now, you already know how important it is to build more wealth at a faster rate if you want to retire early. The question now is this—how much money do I really need to retire comfortably early?

There’s really no single answer for this one. That’s because a lot of things go into figuring out this question. And most of the time, that magic number isn’t the same for everyone.

To help you understand just how much you’ll need to retire early, here are five factors to consider when budgeting for early retirement:

- Current salary and assets

- Value of your superannuation

- Number of years you’ll spend retired

- Desired retired lifestyle

- Expected future expenses

These are all important questions to answer when planning your financial future, and ones we will cover with you in our 1-hour personal finance strategy session. No cost, no obligation – and only takes you three clicks to book. Book your consultation here.

Another good standard to use is those computed by the Association of Superannuation Funds of Australia (ASFA). ASFA classifies retirement living lifestyles into two types:

- Modest retirement: living just above what your Age Pension allows you while only affording basic necessities.

- Comfortable retirement: living a retired life where you can freely participate in leisure activities without worrying too much about the financial consequences.

Depending on the lifestyle you want to live as well as other factors previously mentioned, ASFA estimates your expenses to look something like this for each year you’re retired:

Source: https://www.superannuation.asn.au/resources/retirement-standard

All this might sound a little daunting. With so many factors to consider, it can get confusing and downright intimidating to start budget planning for your early retirement. But with so many more Australians considering early retirement, there are tons of easily accessible retirement calculators you can access to figure out an actual amount.

At Raeburn Advisors can definitely help you plan your way to a worry-free retirement, whether it be earlier or later in your life. Our financial advisors specialise in giving practical advice that will set you on the path to achieving your financial goals.

In fact, we’ve got five tips below to help you kickstart budgeting for your early retirement. Let’s get started…

5 Budget Planning Tips for Early Retirement

1. Create a Retirement Budget

If you plan on retiring early, make sure to include a retirement plan in your budget planning. This retirement budget will become your income once you retire.

According to Canstar’s 2020 Consumer Pulse Report, 79% of Australians are actively saving money. This is great news. However, of these proactive savers, did you know only 4% are making a salary sacrifice in order to make extra super contributions? Why should you be shocked, you wonder? Let’s have a quick look at the impact of long-term saving and compound interest below.

First, a little bit about salary sacrifice:

While a percentage of your current salary already goes to taxes and superannuation (9.5% to be exact), you can take an extra step and consider setting aside 5%–10% more to increase your super contributions further.

Here’s what setting aside 10% of your $8,000 per month income (less tax) looks like after just one year of saving (that’s just $800 per month):

By the end of the year, you would have parked $9,600 in the bank! This is a great way to boost your retirement fund.

However, we haven’t talked about compound interest and growth over time.

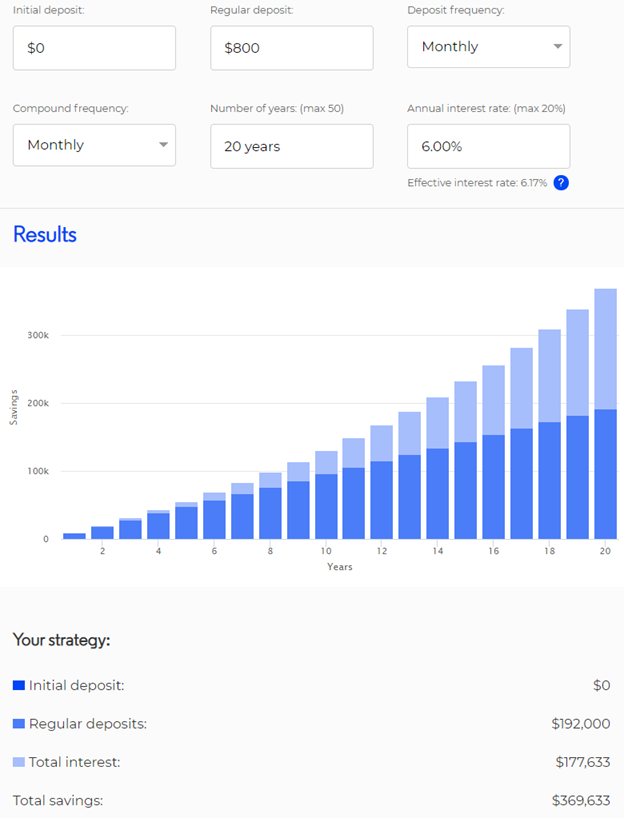

Instead of just putting that money under your mattress (or in a low interest bank account, which unfortunately is most of them these days), let’s run a scenario where you make your $800 per month into a salary sacrifice that goes straight into your superannuation account. Here’s what your savings add up like over twenty years:

See those pale blue columns on top of the darker blue columns? That’s interest. You can see in the summary of the graph that over the course of 20 years your total interest generated is $177,633, which is nearly the same as the amount that you deposited ($192,000)!

If you want to run some of these simulations yourself, you can easily do so using the same tool we did – the MoneySmart Compound Interest Calculator.

FYI: we ran our calculation on a compound interest rate of 6%, which is the typical ROI for superannuation investments over the past 5 years.

Stashing away 10% of your salary might cause you to feel the pinch initially, but your future self will thank you. Think of it this way—you are “buying” entire years of your life where you will not have to work. The sooner you start saving, the sooner you’ll reach your financial retirement goals.

Disclaimer: this scenario is purely hypothetical to illustrate the power of salary sacrifice and compound interest, we have not considered your individual financial circumstances; please consult with your financial planner before making investment decisions.

2. Secure Passive Income Early

What is passive income?: Passive income is money you receive outside of formal employment or social benefits.

Passive income is also another excellent substitute for formal income during your retirement years. Having a stream or two of passive income ensures that you don’t rely on your pension alone. This allows you to enjoy your retired life without worrying too much about expenses later on.

The most common form of passive income is investing. Consider putting some money into investment properties or stocks and bonds that collect dividends.

3. Live Frugally

If you want to retire early, you’ll need to start living a frugal life. Saving like there’s no tomorrow is key to securing your retirement budget.

Take a good, hard look at all your daily expenses. List everything you spend your current salary on, and see what you can get rid of. Consider setting a date every year to do a thorough review of your expenses. Here are examples of things you can start cutting down on:

- Take-out meals (bring packed lunch instead)

- Coffee runs (make your own coffee)

- TV, newspaper, and magazine subscriptions (except those you really watch or read)

- Impulse buys (resist the urge to make spontaneous shopping trips)

- Stop smoking and drinking (your wallet will thank you!)

Building on these habits might hurt at first, but cutting down on your expenses becomes more comfortable over time. Living frugally today means you’ll be able to retire much earlier.

Tip: living frugally can suck, especially in the beginning – to help motivate yourself, keep track of the amount of money you are saving (you can even keep a piggy bank / jar where you “pay yourself” the savings) and at the end of the week total it up to see what difference you made. You’ll be amazed, and stay motivated for the next week.

RELATED: 5 Steps You Can Take Today to Retire Faster

4. Pay Down (and Get Rid of) Your Debt

This one’s a no-brainer. You can’t start budgeting for early retirement if you’re continually paying your debts like those from your credit card company or mortgage provider.

If you’re currently living debt-free—congratulations! Keep it up. But if you’re among the two-thirds of Australians who have some form of debt, don’t hesitate to consult with us. We can help craft a plan that’ll help you pay down and eventually get rid of your debt.

5. Prioritise Your Superannuation Contributions

When it comes to budget planning your early retirement, make sure to prioritise your superannuation contributions. Don’t skip on any payments. And when you can, try to make extra contributions. Not only will this make compound interest your best friend, but making additional contributions is also a great way to get a tax break!

RELATED: Voluntary Super Contributions: Why You Should Start (Yesterday!)

Key Takeaways

Retirement planning is the same whether you want to do it earlier or later in life. The only things you really need to consider when you’re budget planning for early retirement are time and inflation. You’ll need to make the most out of the time you have so that you can build enough wealth to last your retired life.

Budget planning for early retirement isn’t easy. At Raeburn Advisors believe that everyone is entitled to a worry-free retirement. We can help empower you by providing simple steps and practical advice to help make your dream of retiring early a reality.

Enjoying the content? Follow us on Facebook, Instagram, or LinkedIn, and subscribe to our monthly newsletter to make sure you stay up to date.

Disclaimer:

This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.