Centrelink Age Pension: Know How Much You Can Get

By Ross Marshall. Posted: December 2020

Centrelink Age Pension is the Australian Government’s way to provide its elderly constituents with a safety net as they move into retirement. If you’re nearing retirement, read this article to learn more about how you can maximise your Age Pension.

Here are six questions about Centrelink Age Pension that we’ll answer in this article:

- What is Centrelink Age Pension?

- Who is eligible for the Centrelink Age Pension?

- What are the income and assets tests?

- How do the income and assets tests affect my Centrelink Age Pension?

- How much Age Pension can I get?

- How do I get the most out of my Centrelink Age Pension?

Understanding Centrelink Age Pension: What It Is and How to Get the Most Out of It

What is Centrelink Age Pension?

Age Pension is a form of monetary support the Australian Government provides Australian citizens who can’t fully fund their own retirement years. It is managed by and paid through Services Australia, (also/formerly known as Centrelink). As such, age pension in Australia is commonly referred to as Centrelink Age Pension.

TRIVIA: Did you know that according to the Australian Institute of Health and Welfare (AIHW), 2.6 million Australians aged 65 and over received income support payments in 2019 alone?

Who is eligible for the Centrelink age pension?

Not all Australians are eligible for the Centrelink Age Pension. There are three strict criteria you should satisfy to qualify for an Age Pension in Australia. To be eligible, you must be:

- An Australian citizen for at least 10 years;

- At Age Pension age of 66 years and older; and

- Meet limits of the income and assets tests.

Australian citizenship

To be eligible for Age Pension, you must first be an Australian citizen who lived in Australia for at least 10 years. You’re also required to personally file your Age Pension application.

Age Pension age

Generally, Australians aged 66 years and above are at the right Age Pension age to access the Age Pension.

More specifically, your Age Pension age is counted when you’re 65 years old and six months. Your Age Pension age then increases by six months every two years until your Age Pension age is at 67.

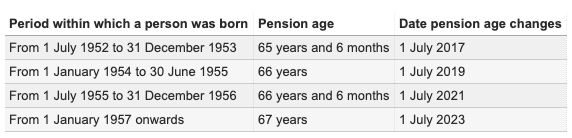

Here’s a table explaining the Age Pension age from the Department of Social Services (DSS) to guide you:

Source: https://www.dss.gov.au/seniors/benefits-payments/age-pension

Your Pension Age is not the same as your retirement age. While there remains no fixed retirement age in Australia, many Australians retire by the age of 55 years old based on 2018–2019 data from the Australian Bureau of Statistics.

Do you ever think about retiring early? Imagine having the time to travel and relax on your own schedule. Here are 5 steps to help you you start your early retirement today!

Income and assets tests

Services Australia also uses two tests to further determine your eligibility for the Age Pension, namely, the Age Pension assets test and the Age Pension income test. These tests set income and asset limits that determine how much pension you receive (or if you’re qualified to receive it at all).

What are the income and assets tests?

Age Pension assets test

Centrelink will take a look at your assets and determine their equivalent market value. Examples of assets they’ll assess are (but not limited to) properties (e.g., houses, condominiums) and vehicles (e.g., cars, caravans).

Age Pension income test

Centrelink’s Age Pension income test takes a look at your sources of income, including those from inside and outside of Australia.

These income sources can include from your:

- Salary

- Investments (including superannuation)

- Current pensions

Services Australia uses deeming rules to determine how much income your assets are worth. Here’s an example of how Service Australia calculates your deemed income when you’re a joint couple with at least one of you getting a pension:

The first $88,000 of your combined financial assets has the deemed rate of 0.25% applied. Anything over $88,000 will earn 2.25%.

How do the income and assets tests affect my Centrelink Age Pension?

How much pension you receive really depends on the outcome of these tests. Your results can determine if you get a full, partial, or no pension at all.

Specifically, you’re paid based on the test that gives you a lower payment rate. Based on current guidelines, most Age Pension applicants fall under the assets test.

There are a lot of factors to consider when talking about your pension as you near retirement. Talk to a financial advisor about your income and assets, so you can financially secure your retirement years.

How much Age Pension can I get?

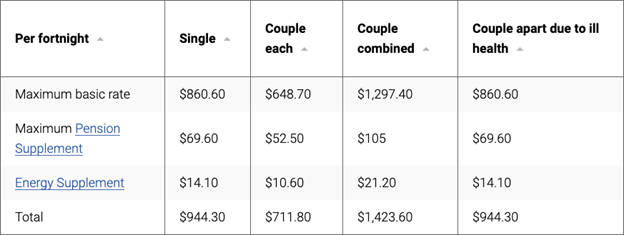

Your Centrelink Age Pension rates depend on whether you’re single or married. These are the normal rates that’ll apply based on Services Australia:

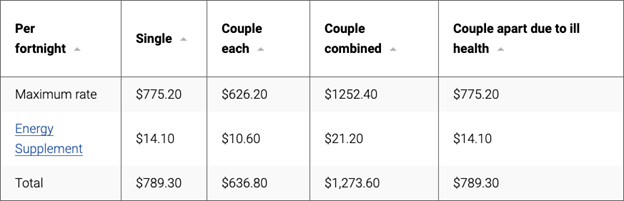

If you’ve been receiving a pension since September 2009, the transitional rates are likely what applies to your Age Pension:

How do I get the most out of my Centrelink Age Pension?

Here are three tips to help you maximise your Age Pension:

1. Capitalise on your younger spouse’s age

Is your spouse below Age Pension age? If they are, you can contribute a portion of your Superannuation to theirs. Doing so exempts that sum of money from being assessed by Centrelink as your asset. This allows you to make the most out of your pension until your spouse reaches Age Pension age.

2. Gifting

Another way to maximise your Age Pension is to consider giving your family and close friends a portion of your personal wealth. This is called gifting. Doing this also reduces the assets Centrelink will assess, which consequently raises the Age Pension you’ll be paid.

Timing is crucial when it comes to gifting. If you’re planning on using this strategy, early gifting is advised. Do note that there are limits, so it’s best to consult an experienced financial advisor to help you time the gifting just right.

3. Structure your income and assets efficiently

You can still get a sizable sum from your Age Pension even if you don’t have that much income or assets. To do this, you need to structure your assets as efficiently as you can. At Raeburn Advisors, we’re committed to helping you achieve your financial goals. Our seasoned panel of financial planners provides simple, practical, and professional financial advice that can lead to a fulfilling and stress-free retirement!

Key Takeaways

The best way to make the most out of your Centrelink Age Pension is to plan well and ahead. There are tips you can follow to start maximising your pension. Still, nothing beats getting practical financial advice from the experts to secure your financial future.

You shouldn’t be burdened by debt or money troubles when you reach your retirement age. That’s why we at Raeburn Advisors believe that everyone—including you—deserves a worry-free retirement. We can help you manage your income and assets, so you can secure your retirement as early as today! Reach out to us or book a free consultation to talk about your circumstances and financial goals.

Enjoying the content? Follow us on Facebook, Instagram, or LinkedIn, and subscribe to our monthly newsletter, to make sure you stay up to date.

Disclaimer:This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.