What Is a Superannuation Re-Contribution Strategy?

By Ross Marshall. Posted: January 2021

What Is a Superannuation Re-Contribution Strategy?

In this article:

When it comes to superannuation, you might have heard of a concept called a re-contribution strategy. Many financial advisors float this idea with their clients—with good reason! Read this article to learn more about what a re-contribution strategy is and how it can benefit you.

- What is a re-contribution strategy?

- Why implement a re-contribution strategy in the first place?

- How does a re-contribution strategy work?

- Who is eligible for it?

- When is superannuation re-contribution not beneficial?

Re-Contribution Strategy: What It Is and How It Benefits Your Superannuation

What is a re-contribution strategy?

Superannuation re-contribution, also known as a re-contribution strategy, happens when you withdraw part or all of your super balance then put it back in as a non-concessional contribution.

Re-contribution is a strategy that many savvy financial advisors may recommend to their clients. The question is, why go through the trouble of taking from your super then putting it all back in? Well, this is where the value of having a professional on your side comes in…read on.

Why implement a re-contribution strategy in the first place?

It’s all about the tax. To better understand this, let’s first talk about the two tax components of superannuation:

1. Tax-Free Component

The tax-free component of your superannuation is the total after-tax contributions you put into your super. Because the contribution you made is already tax-deducted, you don’t have to pay taxes again when you withdraw them in the future.

Examples of after-tax contributions that fall under the tax-free component are non-concessional contributions and contributions you put in from your investment earnings.

2. Taxable Component

Your super’s taxable component comes from your mandatory, known as concessional, contributions. This includes the contributions you make from your superannuation guarantee (SG) and salary sacrifice deductions.

The taxable component of your super is computed this way:

Taxable Component = Total Superannuation Balance – Total Non Concessional Contributions

Simply put, the taxable component is what’s left when you deduct all your non-concessional contributions from your super’s total balance.

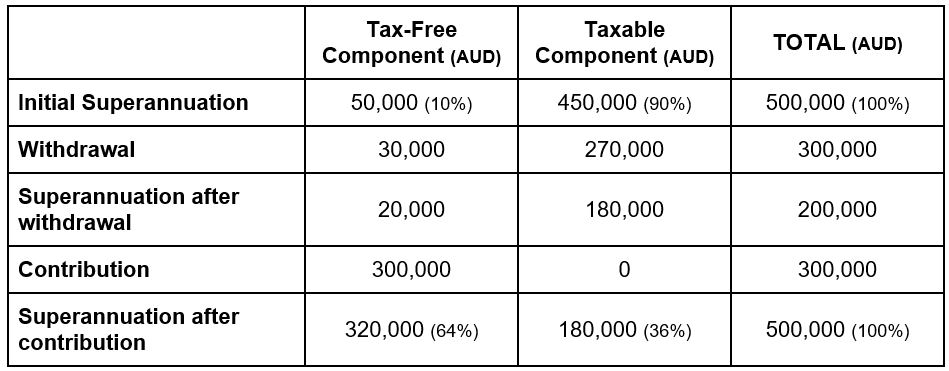

Let’s say your superannuation balance is at $500,000. Through the years, you’ve made a total of $50,000 in non-concessional contributions. Using the formula, your super’s taxable component is $450,000. That would make the proportion of your super’s taxable and non-taxable components at 90% and 10%, respectively.

IMPORTANT: When withdrawing from your superannuation, you can’t take exclusively from the non-taxable component. You withdraw proportionally between your super’s taxable and non-taxable percentages. Using our example, if you have a total of $500,000 in your superannuation (with a 90/10 taxable/non-taxable split) and would like to withdraw $300,000, 10% of the $300,000 will come from your non-taxable component, while 90% will come from the taxable component, which is, unfortunately, subject to tax deductions.

So, why withdraw then re-contribute your superannuation?

To make the most out of your superannuation withdrawal, it’s always best when your account has a higher tax-free component versus the taxable component. Re-contribution is a way to ensure this as it turns your super’s taxable component into a tax-free one. Here’s how you stand to benefit:

- Deceased Estate Planning: Re-contribution reduces the taxable component of your super. This lessens, or even eliminates, the tax your beneficiaries have to pay when they inherit your deceased estate.

- Future Tax Planning: If you withdraw from your super while you’re under the age of 60, you’ll be taxed for much less, giving you a higher net withdrawal at a smaller tax rate.

- Transfer Caps Between Spouses: This strategy allows you to withdraw your super and contribute it to your spouse’s account. So, as a couple, you can have double the amount invested in tax-free income streams.

How does a re-contribution strategy work?

Let’s go back to our initial example where you have a hypothetical superannuation balance of $500,000. For this example, we’ll assume you’re between the ages of 60–65 and have met all the conditions to make you eligible for total superannuation benefits.

To implement the re-contribution strategy, you can withdraw $300,000 from your superannuation account. When you re-contribute this $300,000 back into your superannuation, you’ll declare it as a non-concessional contribution, effectively increasing the percentage of your super’s non-taxable component.

Here’s how the computation for this example goes:

See how after re-contributing that $300,000 as a non-concessional contribution bumped up the percentage of your non-taxable component up to 64%? That’s a significant increase from your initial 10%, and even in the short term can save you thousands of dollars per year in taxes, as well as tens of thousands saved on things like death benefits tax.

TIP: Many complex tax calculations and eligibility rules go into implementing a sound superannuation re-contribution strategy. Before withdrawing any amount from your super, it’s best to consult a financial advisor. Contact us at Raeburn Advisors, and let’s talk about a re-contribution strategy that best suits your current finances.

Who is eligible?

To implement superannuation re-contribution, you first have to be eligible to withdraw lump sums from your account. Plus, you also need to be qualified to re-contribute funds into your superannuation.

You’ll generally have to meet one or more of the following criteria:

- Reached your preservation age (55 to 60 years old) and retired

- Reached age 65 (retired or not)

- Ceased work temporarily or permanently due to injury or illness

- Are able to access your super on other grounds

When is superannuation re-contribution not beneficial?

As beneficial as a re-contribution strategy sounds, it does have some potential pitfalls and disadvantages—here are key things to look out for:

- Re-contribution can affect how your taxable income is computed. This can lead you to pay more taxes upfront.

- Implementing this strategy when you’re under the age of 60 can make you susceptible to taxes.

- Superannuation re-contribution amounts have limits, too. You can incur penalty fees when you go over the cap.

- If you’re not careful you can exceed the lump-sum tax-free threshold

- Make sure you don’t exceed your non-concessional contribution limits (including carry-forward cap) – especially relevant if you are using other strategies to boost your super

Bonus Tip: How to maximise your Age Pension using Re-Contribution Strategy

It is common for one person in a couple to reach Age Pension age (66 years) before their partner – unless you’re born on the same day, someone is usually a little bit older! As you may know, the Age Pension amount you receive is calculated based on your Income and Assets test – including how much superannuation you have saved. The more super you have, the less Age Pension you’ll get.

In this case, a useful strategy you can use to get more out of your Age Pension, is to reduce your on-paper superannuation by using a re-contribution strategy to transfer some or all of your super to your (younger) partner’s superannuation account. This reduces your assessable assets which will increase your Age Pension amount, while still allowing your super savings to accrue interest in your partner’s account.

Key Takeaways

A correctly executed re-contribution strategy can have a host of benefits, helping to reduce your taxes, minimise your assessable assets, and also helps you plan your deceased estate, ensuring that your loved ones get the most out of your assets even when you’re gone, as well as help you maximise the amount of Age Pension and other Centrelink payments you or your partner may receive.

While we presented a simple calculation showing how most re-contribution strategies work, it’s important to note that many tax calculations and eligibility rules need to be considered. So, before you withdraw from your superannuation, seek financial advice from a financial planning expert to ensure this strategy is suitable for you.

At Raeburn Advisors, we make it our mission to help build a path for our clients that lead them to their financial goals. If you want to learn more about re-contribution or other strategies to maximise your super and retirement income, give us a call or book a free consultation. We’d love to hear from you!

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.