The Truth About Retirement Age in Australia

By Ross Marshall. Posted: December 2020

So, what’s the real retirement age in Australia? How has this changed over time? And how has COVID-19 affected retirement in Australia? In this article, we’ll give you the answer to all those questions, and more.

In this article, we’ll answer these questions about retiring in Australia:

- What is the retirement age in Australia?

- At what age do Australians usually retire?

- Has the COVID-19 pandemic affected retirement plans for Australians?

- With all that said, when should I retire?

- What other things do I have to consider before I retire?

Here’s What You Need to Know About the Retirement Age in Australia: 5 FAQs Answered!

What is the retirement age in Australia?

Answering questions like, “What is the retirement age in Australia?” or “What age do I retire?” aren’t as straightforward as you think. That’s because there isn’t one. No Australian law dictates when you should retire.

However, there are two essential ages to note when talking about retirement planning. It’s critical to know these because it’s at these stages in your life when you’ll be able to access government-sponsored retirement funds. Here they are:

- Preservation age

- Age Pension age

Preservation Age

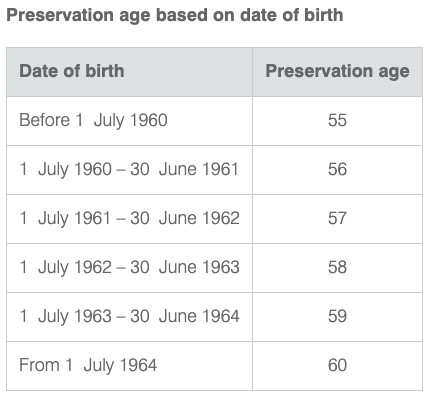

When you’re of Preservation age, you’ll be able to access your superannuation. The Australian Taxation Office (ATO) states that your Preservation Age depends on your birthday. Take a look at their guidelines below:

Age Pension Age

When you’ve reached your Age Pension age, you’ll be entitled to receive Australia’s Age Pension. This is a form of monetary support the Australian Government provides a retirement fund for elderly Australians.

Services Australia (formerly Centrelink), the office that manages Age Pension, will use your birthday to determine your Age Pension age using this chart:

Source: https://www.servicesaustralia.gov.au/individuals/services/centrelink/age-pension/who-can-get-it

Other than your Age Pension age, Services Australia considers other factors to see if you’re eligible for the Age Pension. These include such as your citizenship status, income, and assets.

If that’s the case, at what age do Australians usually retire?

The Australian Bureau of Statistics’ (ABS) recent Retirement and Retirement Intentions report revealed that the average retirement age of Australians aged 45 years and over is currently at 55.4 years old.

According to the ABS Retirement and Retirement Intentions report, Australians retire because of these three reasons:

- They reached retirement age or became eligible for superannuation (46%)

- They’ve gotten sick, injured, or disabled (21%)

- They’ve been dismissed from their jobs or there’s no work available (11%)

These three reasons suggest that people’s decision to retire varies from one Australian to another. While many Australians voluntarily retire, some circumstances, like sickness and job loss, also cause some to forcefully retire.

While majority of Australians aged 45 years and above have been pegged to retire by age 55, it’s important to know that retirement isn’t a one-time event. For example—you might retire at 55 years old, but you can jump back into the workforce later on for whatever reason. In fact, the Household, Income, and Labour Dynamics in Australia’s (HILDA) 2017 survey found that one in four retired Australians aged 45-59 years go back to work a year after retiring.

Trends on the retirement age in Australia

On average, Australian women retire sooner than men. From 2018–2019 alone, 55% of Australia’s retired population were women.

While those aged 45 years and over retire at the average age of 55 years, the past five years has been quite different. According to the Australian Bureau of Statistics’ (ABS) Retirement and Retirement Intentions 2018–2019 survey, the retirement age of Australians, as a whole, has been steadily rising. This means that many Australians are generally retiring much later in life. The increase in retirement age is also expected to continue in the coming years. Experts noted that there are twice as many Australians aged 65–74 years old in the workforce today since the turn of the century.

So, what’s forcing many Australians to keep working well into their 60s and 70s? Money Magazine noted that the would-be culprits are (1) depressed wage growth and (2) low interest rates.

Depressed wage growth

As the years go by, the prices of goods have increased disproportionately with Australians’ wages. This slow wage growth makes it much harder for would-be retirees to save.

Low interest rates on savings

Interest rates for traditional savings accounts have remained low for several years now. The RBA’s record low cash rate is great for people borrowing but tough on people who want to save. This combined with the continued trend of depressed wage growth is forcing many Australians to work longer to compensate for retirement expenses in the future.

Has the COVID-19 pandemic affected retirement plans for Australians?

Yes, it has.

COVID-19 hit the Australian economy hard in early 2020, causing many to lose their jobs and source of income. To help support those financially hurt by the pandemic, the Australian Treasury allowed people to access up to $10,000 of their superannuation regardless of age.

To date, Australians have withdrawn 56% more from superannuation than the government anticipated, likely as a way to meet day-to-day expenses and pay for loans during these challenging times. According to the Australian Prudential Regulation Authority’s (APRA) latest COVID-19 Superannuation Early Release Scheme report, around $35.5 billion worth of retirement funds have been withdrawn as of November 2020.

While the scheme provides momentary financial relief, many experts are criticising it, believing that withdrawing from the superannuation this early endangers many Australians’ future retirement income. This is especially alarming as reports have shown that the majority of those taking from their super are younger Australians.

Dr. Andrew Charlton, renowned economist and former adviser to Prime Minister Kevin Rudd, shared this fear, too. In an opinion piece he wrote for The Sydney Morning Times, Dr. Charlton noted that many young Australians today don’t value their superannuation enough because of their belief that retirement is “literally half a lifetime away.”

This leads many young Australians to become disengaged from their retirement funds early on. Given that they are among the biggest withdrawers during the pandemic, young Australians are setting themselves up to “lose the most from decades of forgone [superannuation] returns.”

Withdrawing from your retirement income now obviously leaves you with less to go on later for when you actually retire. This, coupled with the financial unpredictability prompted by COVID-19, has already delayed many working Australians’ retirement plans. In fact, as many as 45% of Australians aged 30–65 years old don’t feel financially confident about retiring.

With all that said, when can I retire?

Since there is no set retirement age in Australia, the better question would be, “When should I retire?“

There’s no set answer to this question. That’s because deciding when to retire ultimately depends on you and your current financial situation. Ask yourself this—if I retire now, do I have enough wealth to last me my retirement years?

More than your age, it’s also essential to think about the COVID-19 pandemic and its long-term effects on the Australian economy and your finances when deciding your retirement.

It’s always best to have a flexible approach to your finances so your future wealth can adapt to the economy’s ups and downs. Get financial advice as early as now, so you can financially secure your retirement, whenever it is!

What other things do I have to consider before I retire?

Your current (and future) health.

When it comes to retirement planning, there’s nothing more accurate than the saying “health is wealth.” Staying healthy now lets you work longer and earn more. Doing so means you’ll be able to contribute to your superannuation and save for your retirement fund.

Health is also a critical factor in determining your productive years as you get older. You can’t stop the effects of aging on your stamina to work. This makes it even more important to keep up with your superannuation contributions and save on what you can much sooner than later.

RELATED: Voluntary Super Contributions: Why You Should Start (Yesterday!)

The number of years you’ll be retired.

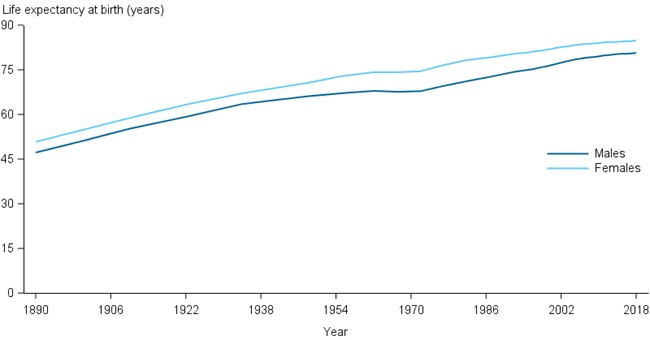

Australians are living much longer than before. According to the Australian Institute of Health and Welfare (AIHW), men born in 2016–2018 can live to their 80s, while women can live to the age of 85 years old.

Source: https://www.aihw.gov.au/reports/life-expectancy-death/deaths-in-australia/contents/life-expectancy

While living to an older age gives you more time to enjoy life, it also means you’ll need deeper pockets to help you pay for extended years you’re retired. At Raeburn Advisors, we’ll work with you in planning a worry-free retirement through practical and straightforward financial advice. Book a call with us now to get started!

The retirement lifestyle you want to live.

You should also consider the lifestyle you want to live upon retirement. You’ll need more money if you’re going to spend beyond your needs during your retirement.

The Association of Superannuation Funds of Australia (ASFA) defines two different retirement lifestyles:

- Modest retirement: living just above what your Age Pension allows you while only affording basic necessities.

- Comfortable retirement: living a retired life where you can freely participate in leisure activities without worrying too much about the financial consequences.

Take a look at ASFA’s estimates for a year’s worth of expenses based on the lifestyle you want to live:

Source: https://www.superannuation.asn.au/resources/retirement-standard

Key Takeaways

At the end of the day, there is no set retirement age in Australia. The age you retire depends on your financial circumstances and the lifestyle you want once you retire.

Instead of asking, “what age should I retire”, a better question to ask “what steps can I put in place to ensure I can retire when I want?”. The sooner you prepare, the smoother your retirement will be.

At Raeburn Advisors we are committed to helping everyday Australians secure a positive financial future, including a stress-free, comfortable, enjoyable retirement. We can help you craft a plan that’ll safeguard the retirement you want for yourself, whenever you decide you’re ready. Contact us today to learn more about how we can help.

COMING SOON: How much super do you need to retire?

Enjoying the content? Follow us on Facebook, Instagram, or LinkedIn, and subscribe to our monthly newsletter, to make sure you stay up to date.

Disclaimer:

This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.