How Much Super Do You Need to Retire?

By Ross Marshall. Posted: February 2021

Having a well-managed superannuation balance is your ticket to living the retirement life of your dreams. As distant as you think retirement may be, it’s critical to get on top of your super today to ensure you hit your retirement goals. So, how much do you really need to retire? We’ll tell you the answer to that and advise you about how you can get that magic number!

In this article:

- What is superannuation and why is it important?

- How does superannuation work?

- How does my current super balance compare?

- How much super do I need to retire?

- What can I do to boost my superannuation?

- Maximise Your Superannuation with Raeburn Advisors

Hitting the Superannuation Sweet Spot: How Much Is Enough and How Do I Get There?

What is superannuation and why is it important?

Superannuation, super for short, is a way of saving money while you’re working and earning an income so you have funds to retire later on.

The Australian Government’s superannuation scheme is compulsory for those who work and live in Australia. What this means is your employer takes a percentage of your income and puts it into your super fund, which you can access in the future when you retire and reach a certain age.

How does superannuation work?

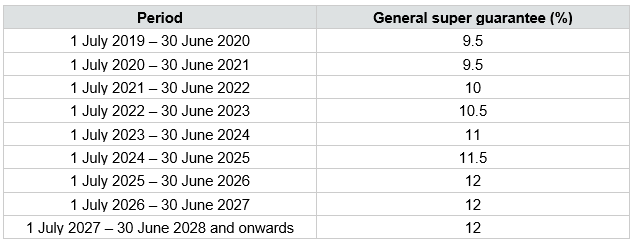

By current Australian law, your employer pays 9.5% of your monthly salary to your super fund, known as your Superannuation Guarantee (SG). While the current percentage is pegged at 9.5%, this percentage is expected to rise as noted by the Australian Tax Office (ATO):

Your employer can also make contributions on top of what they’re mandated to make, so make sure you talk to human resources about it. You can even make extra contributions on your own (and possibly pay less tax), too! This helps ensure that you’ll have more retirement money later on.

How does my current super balance compare?

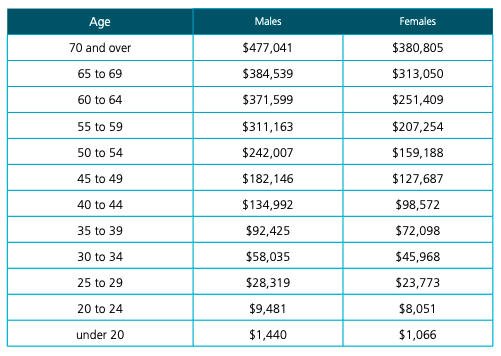

One way to gauge whether your super has a healthy balance is to take a look at how your peers’ superannuation performance. The table below, from ASN’s 2018 report, shows the average superannuation balances of working Australians:

Based on the figures, women tend to have lower super balances than men. This is likely because women often have home and child-care responsibilities which require them to take time off work.

Take a look at the average super balance your age group is estimated to have. Is your superannuation on track? If it is—great! Then again, if your super balance is lagging behind, it could be affected by other things such as your:

- Income

- Employment status and history

- Other commitments (i.e., you took time off to travel or pursue higher studies)

How much super do I need to retire?

It’s easy to find out how much super you have now. Perhaps a more challenging question to answer is how much you’ll actually need to retire?

Do you really need a super balance of $1 million to make your retirement dreams a reality? Or is there a sweet spot that lets you enjoy your money now and save enough for retirement later?

As you might expect, there’s no blanket, “one size fits all” answer for this one. But bear with us – we’re going to help you figure out the target super amount for your circumstances.

A lot of factors come into play when determining if you enough in your super to retire. Consider these things when estimating how much super you’ll really need to kickstart your retirement plan:

Lifestyle you want

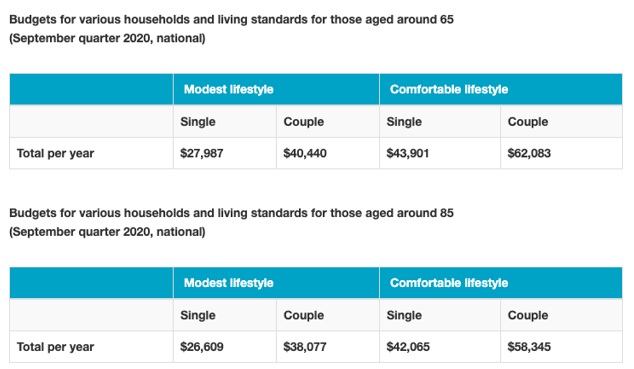

The retirement lifestyle you want to live greatly influences the superannuation balance you’ll need. The Association of Superannuation Funds of Australia (ASFA) classifies retirement lifestyle into two kinds:

- Modest Lifestyle: It’s a retirement lifestyle that affords you fairly basic activities.

- Comfortable Lifestyle: This is a step-up from basic expenses where you’ll be able to afford leisure and recreational activities.

The tables below translate these two lifestyles into numbers and yearly expenses:

These average expenses should give you an idea of how much your superannuation balance should be once you retire. But hang on, we missed a step – how long will you need your super to support you?

Number of years you’re retired

The longer you’re retired, the more years you’ll be without income. As such, you’ll need a lot more funds to sustain the years you’re not working. So it’s a question of knowing how long you’ll be relying on your superannuation—a polite way of estimating life expectancy.

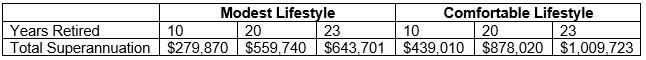

According to the Australian Institute of Health and Welfare (AIHW), men and women who are currently aged 65 can expect to live up to 84.9 and 87.6 years old, respectively. That would mean your super account should be able to pay your expenses for 20–23 years.

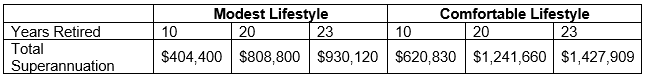

Taking into account the ASFA’s calculated yearly expenses and AIHW’s estimated life expectancy age, here’s how much your super balance should have when you retire by age 65:

Estimated superannuation balance for those single and retiring by age 65:

Estimated superannuation balance for couples retiring by age 65:

State of health

Nobody can stay in absolutely tip-top shape forever. As you get older, you’ll have to pay extra attention to your health. Getting medical care in your old age can take a toll on your finances.

While ASFA’s standards can give you a ballpark estimate as to how much you’ll be needing to tide you over during your retirement, there are two things you’ll need to keep in mind about those numbers—those calculations were made under the assumption that retirees (1) own their own home and (2) are relatively healthy.

So, to know whether your superannuation balance is enough, you have to take into account possible future medical expenses, too.

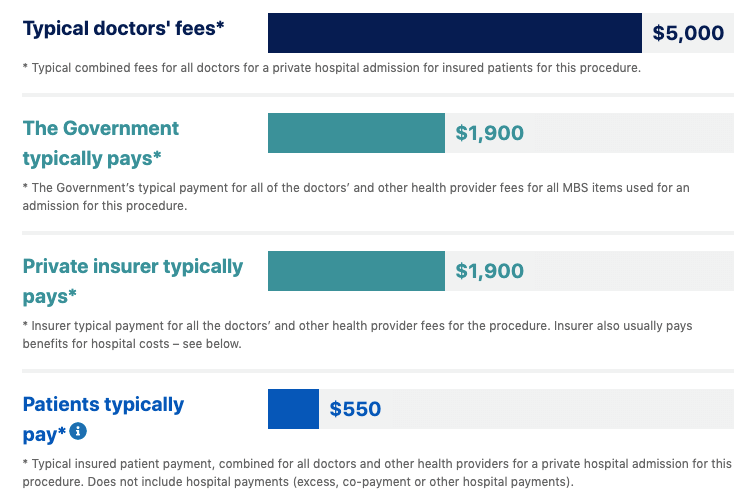

To give you a better picture of what health expenses cost, the Department of Health has a Medical Costs Finder that lets you look up how much common medical services cost in Australia. For example, here’s how much a hip replacement procedure costs:

You can use this tool to benchmark your medical expenses and augment it to your current super balance.

Eligibility for government support

Retiring doesn’t automatically grant you access to your super. According to the Australian Taxation Office (ATO), you can only withdraw from your super when you:

- turn 65 (whether you’re retired or not)

- reach preservation age and retire

- are transitioning into retirement

Based on these rules, you’ll have to be retired much later to be able to withdraw from your super. But what if you want to retire a little early, say by the age of 60? What will you do then? You’ll need to rely on other means of government support in addition to your superannuation fund.

The majority of Australians aged 65 years and above are entitled to these forms of financial support:

- Age Pension: Monetary support the Government provides Australians who can’t fully fund their retirement years. Learn more about Age Pension here.

- Grandparent Child Care Benefit: If you’re a grandparent serving as a primary caregiver to your grandchild or grandchildren, you can claim this benefit which covers up to 50 hours of childcare per child per week.

- Rent Assistance: This is monetary support that can help you pay your rent, whether it be a private accommodation or a care facility.

- Other Supports: Senior Citizen Cards and Senior Supplements

Contact Centrelink to see if you’re eligible for these benefits and how you can benefit from them.

Access to assets, inheritances, and other funds

Do you expect to inherit assets from a loved one in the future? Do you have other assets that may be of value in the future (e.g., a holiday home, investment property, or a business)? This can help augment the superannuation you’ll need upon retirement.

What can I do to boost my superannuation?

Here are five things you can start doing to prep your super for retirement:

- Create a retirement budget

- Secure (and sustain) passive income

- Live frugally

- Pay down (and get rid of) your debts

- Prioritise your superannuation contributions

RELATED: Budget Planning – 5 Awesome Wins For An Earlier Retirement

Maximise Your Superannuation with Raeburn Advisors

Staying on top of your superannuation is key to securing wealth that will let you live the retirement life you’ve always dreamed of having. Apart from going on super-saver mode, there are a variety of other financial strategies you can adopt to get your superannuation where it needs to be.

It can be tricky to navigate these superannuation strategies on your own. Consulting with experienced financial advisors the first step to getting advice that’ll pave the way for well-informed decisions.

That’s what we at Raeburn Advisors are here for. We’ll give you concise, practical, and digestible advice that will grow your superannuation funds and bring you one step closer to your dream retirement. Book a consultation with us, and let’s talk about your retirement goals. We’d love to hear from you!

Enjoying the content? Follow us on Facebook, Instagram, or LinkedIn, and subscribe to our monthly newsletter to make sure you stay up to date.

Disclaimer: This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.